Offshore Trusts Checklist: What to Consider Before Setting One Up

Comprehending the Conveniences and Difficulties of Establishing an Offshore Trust Fund for Asset Protection

When considering possession defense, establishing an overseas count on could seem appealing. It uses personal privacy, potential tax obligation benefits, and a way to secure your possessions from lenders. You'll need to navigate legal factors to consider and compliance problems that vary across jurisdictions.

What Is an Offshore Count On?

An overseas count on is a legal setup where you move your assets to a trust fund that's established outside your home country. This arrangement allows you to manage and protect your riches in a territory with beneficial laws. You can designate a trustee, who will look after the trust fund according to your wishes. By doing this, you're not only safeguarding your properties but likewise potentially taking advantage of privacy and tax obligation advantages inherent in some overseas jurisdictions.

Trick Benefits of Offshore Trust Funds for Property Protection

When considering offshore trust funds for asset defense, you'll discover several essential benefits that can profoundly influence your economic safety and security. These trusts provide enhanced privacy, tax advantages, and a lawful shield from creditors. Comprehending these advantages can help you make informed decisions about your assets.

Boosted Personal Privacy Security

Lots of people seek offshore counts on not simply for monetary advantages, however additionally for enhanced personal privacy protection. By establishing an offshore count on, you can separate your personal assets from your public identification, which can discourage unwanted focus and possible lawful insurance claims. Most overseas territories provide solid discretion legislations, making it challenging for others to access your depend on info. This added layer of personal privacy safeguards your monetary events from prying eyes, whether it's creditors, plaintiffs, and even intrusive neighbors. In addition, you can keep greater control over how your possessions are taken care of and distributed without disclosing sensitive information to the public. Inevitably, an offshore depend on can be an effective device for shielding your personal privacy while protecting your wide range.

Tax Obligation Advantages and Incentives

Beyond boosted personal privacy security, overseas trust funds likewise supply substantial tax obligation advantages and incentives that can furthermore enhance your financial approach. By developing an overseas depend on, you may delight in minimized tax liabilities depending on the jurisdiction you choose. Numerous nations offer desirable tax rates or exceptions for trusts, enabling your properties to grow without the burden of too much tax.

Legal Shield From Creditors

Establishing an overseas trust fund gives you an effective legal shield versus lenders, guaranteeing your possessions continue to be secured in the face of financial difficulties. By placing your possessions in an offshore count on, you develop a barrier that makes it hard for lenders to access them. In addition, offshore trust funds commonly operate under different lawful jurisdictions, which can provide more advantages in property protection.

Legal Factors To Consider When Establishing an Offshore Depend On

When you're establishing an overseas depend on, understanding the legal landscape is necessary. You'll require to thoroughly select the appropriate jurisdiction and assurance compliance with tax obligation laws to protect your possessions properly. Ignoring these elements might lead to costly errors down the line.

Territory Option Criteria

Selecting the ideal territory for your overseas depend on is crucial, as it can considerably impact the effectiveness of your possession protection technique. The ease of depend on facility and recurring administration likewise matters; some jurisdictions use structured processes. In addition, evaluate any kind of privacy legislations that safeguard your info, as discretion is commonly a key incentive for picking an offshore depend on.

Conformity With Tax Rules

Comprehending conformity with tax obligation regulations is important for the success of your offshore depend on. Falling short to report your overseas trust fund can lead to severe charges, consisting of hefty fines and prospective criminal costs. Consulting a tax obligation professional who specializes in overseas trusts can assist you browse these complexities.

Potential Tax Obligation Advantages of Offshore Depends On

While several individuals think about offshore counts on largely for possession security, they can additionally offer considerable tax obligation advantages. By positioning your assets in an overseas depend on, you might gain from extra beneficial tax obligation therapy than you would certainly get in your home country. Several territories have reduced or absolutely no tax rates on earnings created by possessions kept in these trust funds, which can cause significant More Bonuses savings.

In addition, if you're a non-resident recipient, you might prevent specific regional tax obligations completely. This can be specifically helpful for those wanting to maintain riches throughout generations. Furthermore, overseas trusts can supply flexibility in dispersing revenue, potentially enabling you to time distributions for tax performance.

Nonetheless, it's important to speak with a tax specialist knowledgeable about both your home nation's regulations and the overseas jurisdiction's regulations. Taking benefit of these potential tax obligation advantages needs cautious preparation and conformity to guarantee you stay within lawful borders.

Difficulties and Dangers Related To Offshore Trust Funds

Although offshore counts on can use numerous benefits, they likewise feature a selection of challenges and risks that you must carefully think about. One considerable obstacle is the complexity of establishing up and keeping the count on. You'll require to browse numerous lawful and regulatory demands, which can be lengthy and might require professional support.

Furthermore, prices can rise quickly, from legal fees to continuous administrative expenses. It's also essential to identify that overseas depends on can draw in examination from tax obligation authorities. Otherwise structured properly, you could face charges or enhanced tax liabilities.

Furthermore, the potential for adjustments in regulations or political environments in the jurisdiction you've picked can present risks. These changes can affect your trust fund's performance and your access to assets. Inevitably, while overseas counts on can be advantageous, comprehending these challenges is vital for making educated decisions about your property security technique.

Choosing the Right Jurisdiction for Your Offshore Trust Fund

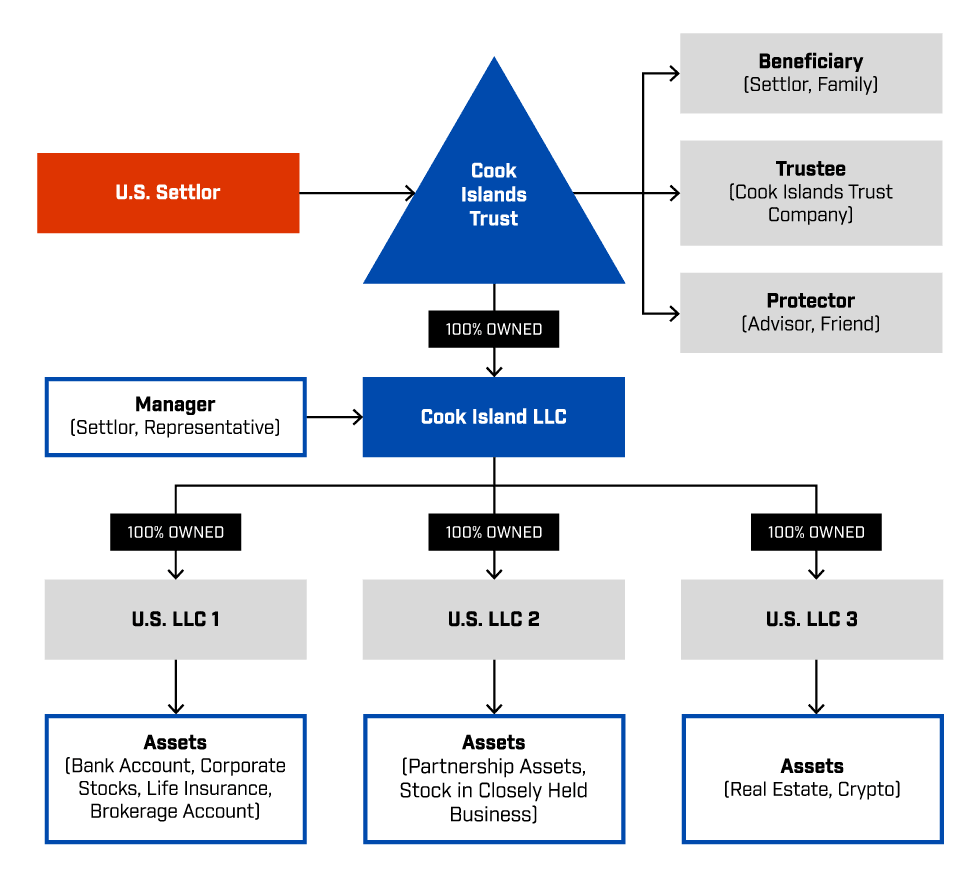

Exactly how do you pick the ideal jurisdiction for your offshore count on? Start by considering the lawful framework and asset protection legislations of potential territories. Search for places known for strong privacy protections, like the Chef Islands or Nevis. You'll additionally desire to review the territory's track record; some are extra respected than others in the monetary globe.

Next, think of tax obligation effects. Some jurisdictions supply tax obligation advantages, while others might not be as beneficial. Offshore Trusts. Access is an additional factor-- choose a location where you can easily interact with trustees and lawful specialists

Lastly, think about the political and financial security of the territory. A steady setting warranties your properties are much less most likely to be influenced by unanticipated changes. By carefully weighing these factors, you'll be better equipped to select the right territory that straightens with your property defense objectives.

Actions to Establishing an Offshore Count On Effectively

Establishing an offshore trust successfully requires mindful preparation and a collection of calculated steps. You need to choose the best jurisdiction based on your asset defense objectives and lawful needs. Study the tax obligation effects and personal privacy regulations in possible places.

Next, choose a reputable trustee who understands the nuances of offshore trusts. This person or establishment will certainly handle the depend on and warranty conformity with local regulations.

As soon as you've chosen a trustee, draft a complete trust deed detailing your purposes and the recipients included. It's smart to seek advice from legal and monetary experts throughout this procedure to verify whatever aligns with your purposes.

After finalizing the documents, fund the depend on by transferring assets. Maintain interaction open with your trustee and examine the depend on occasionally to adjust to any modifications in your circumstance or appropriate legislations. Following these actions carefully will help you develop your overseas depend on efficiently.

Regularly Asked Inquiries

Exactly how Much Does It Price to Set up an Offshore Trust?

Establishing an offshore trust fund normally costs between $5,000 and $20,000. Factors like intricacy, jurisdiction, and specialist costs affect the overall cost. You'll desire to allocate ongoing maintenance and legal costs also.

Can I Be Both the Trustee and Recipient?

Yes, you can be both the trustee and recipient of an overseas trust, but it's vital to recognize the lawful effects. It might complicate asset protection, so consider you can try this out seeking advice from a specialist for advice.

Are Offshore Trusts Legal for United States People?

Yes, overseas trust funds are lawful for united state people. You must comply with tax reporting requirements and guarantee the depend on aligns with U.S. laws. Consulting a hop over to here lawful professional is vital to browse the complexities involved.

What Occurs if My Offshore Count On Is Challenged?

If your offshore trust fund is tested, a court might scrutinize its legitimacy, possibly bring about property healing. You'll need to provide proof supporting its validity and objective to safeguard versus any type of claims effectively.

Just how Do I Select a Trustee for My Offshore Count On?

Choosing a trustee for your overseas count on includes evaluating their experience, reputation, and understanding of your objectives. Search for a person trustworthy and experienced, and make sure they know with the legislations regulating overseas depends on.